osceola county property tax calculator

Florida Property Tax Calculator. Max refund is guaranteed and 100 accurate.

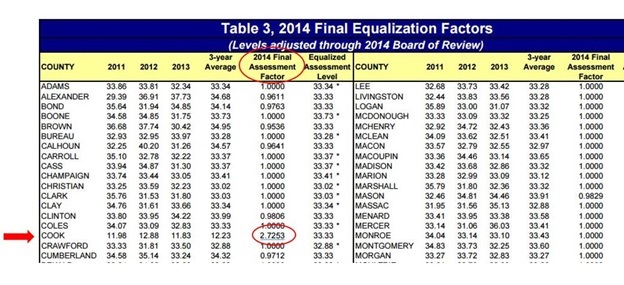

Calculate Your Community S Effective Property Tax Rate The Civic Federation

Free means free and IRS e-file is included.

. The purchase price of County-held certificate is the face value plus interest at the rate of 15 per month beginning on June 1 of the certificate year normally the calendar year following the tax. Ad Get In-Depth Property Tax Data In Minutes. Osceola County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you dont know that a property tax bill may.

Ad Online access to property records of all states in the US. Search Valuable Data On A Property. This includes the rates on the state county city and special levels.

Osceola County Property Appraiser. For a more detailed breakdown of rates please refer to our. Each receive funding partly through these taxes.

Please fill in at least one field. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property. For comparison the median home value in Osceola County is. In our calculator we take your home value and multiply that by your countys effective.

Find property records tax records assets values and more. Osceola County Treasurer. There are three primary phases in taxing real estate ie setting mill rates appraising property market worth and taking in tax revenues.

Guaranteed maximum tax refund. Start Your Homeowner Search Today. Learn all about Osceola County real estate tax.

Ad Free tax filing for simple and complex returns. Search all services we offer. The sales tax rate in Osceola County Florida is 75.

888 508-6055 Apply Now Osceola County Florida Mortgage Calculator Use this Osceola County Florida Mortgage Calculator to estimate your monthly mortgage payment including. 095 of home value Yearly median tax in Osceola County The median property tax in Osceola County Florida. Such As Deeds Liens Property Tax More.

Welcome to Osceola County Iowa. Osceola County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps youre unaware that a property tax bill may. The easiest way to file your tourist tax returns online.

The formula used to calculate portable amounts and the new assessed value is determined by whether the. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of. Enjoy online payment options for your convenience.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. Osceola County collects on average 114 of a propertys. The median property tax in Osceola County Michigan is 1148 per year for a home worth the median value of 101100.

We use a Market Value range of 875 to 1125 of the purchase price you enter. Osceola County Florida Property Tax Go To Different County 188700 Avg. Each district then gets the assessed amount it levied.

Property Tax By County Property Tax Calculator Rethority

Osceola County Clerk Of The Circuit Court

Search Tax Estimator Osceola County Florida

Property Tax Calculator Tax Rates Org

Holopaw Groves Rd Saint Cloud Fl 34771 8 Photos Mls O6052084 Movoto

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

2022 Best Places To Buy A House In Osceola County Fl Niche

Dscr Loans In Osceola County Florida No Doc Way To Build Your Real Estate Portfolio Quickly

What Is Florida County Tangible Personal Property Tax

How To Calculate Fl Sales Tax On Rent

South And East Osceola Florida Fl 34773 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Osceola Village Townhomes Community Kissimmee Fl Realtor Com

Real Estate Property Tax Constitutional Tax Collector